Delving into Money Management Apps vs Professional Advisors, this introduction immerses readers in a unique and compelling narrative. From exploring the world of digital financial tools to understanding the role of seasoned financial experts, this discussion aims to shed light on the pros and cons of each approach.

Money Management Apps

Money management apps are becoming increasingly popular for helping individuals take control of their finances. These apps offer a range of features to assist users in tracking expenses, setting budgets, and achieving financial goals.

Features of Popular Money Management Apps

- Expense Tracking: Many money management apps allow users to categorize and track their expenses, providing a clear overview of where their money is going.

- Budgeting Tools: These apps often include budgeting tools that help users set spending limits for different categories and track their progress.

- Goal Setting: Users can set financial goals, such as saving for a vacation or paying off debt, and track their progress towards achieving them.

- Bill Reminders: Some apps offer bill reminders to help users avoid late payments and stay on top of their financial obligations.

Benefits and Limitations of Using Money Management Apps

- Benefits:

- Convenience: Money management apps provide users with easy access to their financial information anytime, anywhere.

- Automation: These apps can automate tasks like expense tracking and bill payments, saving users time and effort.

- Insights: By analyzing spending habits, users can gain valuable insights into their financial behaviors and make informed decisions.

- Limitations:

- Security Concerns: Users may have concerns about the security of their financial data when using money management apps.

- Accuracy: Apps may not always categorize expenses correctly, leading to inaccuracies in budget tracking.

- Cost: While many money management apps are free, some may require a subscription for access to premium features.

Examples of How Money Management Apps Help Users Track Expenses

Money management apps like Mint or YNAB allow users to connect their bank accounts and credit cards to automatically track expenses. Users can see detailed breakdowns of their spending by category, making it easy to identify areas where they can cut back.

How Money Management Apps Can Assist in Setting and Achieving Financial Goals

These apps enable users to set specific financial goals, such as saving a certain amount of money each month or paying off a credit card balance. By tracking progress towards these goals and receiving timely reminders, users are more likely to stay motivated and accountable for their financial decisions.

Professional Advisors

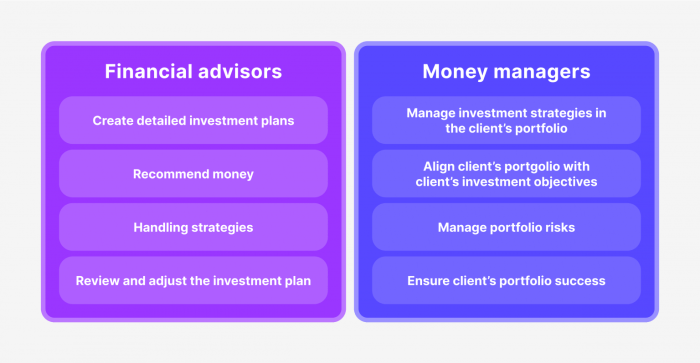

Professional financial advisors play a crucial role in helping individuals and businesses make informed decisions about their finances. They offer personalized guidance and expertise to help clients achieve their financial goals and secure their financial future.Seeking advice from professional advisors comes with several benefits.

These include expert knowledge and experience in financial planning, investment management, retirement planning, estate planning, tax strategies, and more. Professional advisors can provide valuable insights and recommendations tailored to each client's unique financial situation and goals.

Types of Financial Services Offered

Professional advisors offer a wide range of financial services to meet the diverse needs of their clients. These services may include:

- Financial planning: Creating a comprehensive financial plan to achieve short-term and long-term financial goals.

- Investment management: Developing and managing an investment portfolio aligned with the client's risk tolerance and objectives.

- Retirement planning: Helping clients plan for a secure retirement by maximizing savings and optimizing retirement account strategies.

- Estate planning: Assisting clients in creating an estate plan to protect assets and ensure a smooth transfer of wealth to heirs.

- Tax planning: Developing strategies to minimize tax liabilities and maximize tax efficiency.

Personalized Financial Planning

Professional advisors offer personalized financial planning services tailored to each client's individual needs and goals. They take into account factors such as income, expenses, assets, liabilities, risk tolerance, investment objectives, and time horizon to create a customized financial plan. This personalized approach ensures that clients receive guidance and recommendations that are specific to their unique financial circumstances, helping them make informed decisions and achieve financial success.

Comparison

When it comes to managing your finances, it's essential to consider the costs associated with using money management apps versus hiring professional advisors. Additionally, understanding the level of customization available in money management apps compared to advice from professional advisors is crucial.

Let's also explore scenarios where using money management apps might be more suitable than consulting a professional advisor, as well as the security measures in place for financial data on these apps versus sharing information with professional advisors.

Cost Comparison

Money management apps often come with a lower cost or are even free to use, making them a more budget-friendly option for those looking to track their finances. On the other hand, hiring a professional advisor can be costly, as they typically charge fees or a percentage of assets under management for their services.

Level of Customization

Money management apps offer a high level of customization, allowing users to set specific financial goals, track spending habits, and create personalized budgets. Professional advisors, while providing tailored advice, may not offer the same level of customization as apps that cater to individual preferences and financial situations.

Suitability of Money Management Apps

- For individuals looking to track their daily expenses and manage their budget effectively, money management apps like Mint or YNAB can be more suitable than consulting a professional advisor.

- Young adults or individuals new to managing their finances may find money management apps more user-friendly and accessible compared to seeking advice from a financial advisor.

Security Measures

Money management apps prioritize the security of financial data by using encryption technology and secure login processes to protect users' information. However, sharing sensitive financial details with professional advisors also requires trust and compliance with industry regulations to safeguard personal data.

User Experiences

When it comes to managing finances, user experiences play a crucial role in determining the effectiveness of money management apps versus professional advisors. Let's take a look at testimonials, success stories, and tips for users in navigating these options.

Testimonials and Reviews

- One user praised a money management app for its easy-to-use interface and budget tracking features, helping them save more efficiently.

- Another user highlighted the convenience of accessing their financial information anytime, anywhere through a money management app, making it easier to stay on top of their finances.

Success Stories with Professional Advisors

- A young professional shared how working with a financial advisor helped them create a comprehensive retirement plan, ultimately leading to early retirement with financial security.

- Another individual credited their financial advisor for guiding them through investment decisions, resulting in significant portfolio growth and wealth accumulation.

Convenience of Money Management Apps vs Personalized Approach of Advisors

Money management apps offer convenience and accessibility, allowing users to track their finances on-the-go and receive automated insights. On the other hand, professional advisors provide a personalized approach, offering tailored financial advice based on individual goals and circumstances.

Tips for Effective Combination of Apps and Advisors

- Utilize money management apps for daily budgeting, expense tracking, and financial goal setting.

- Consult with a professional advisor for in-depth financial planning, investment strategies, and retirement planning.

- Regularly review and update both your app data and advisor recommendations to ensure alignment with your financial goals.

Summary

As we wrap up this comparison between Money Management Apps and Professional Advisors, it is evident that both avenues offer distinct advantages depending on individual needs. Whether opting for the convenience of an app or the personalized guidance of an advisor, making informed decisions is key to achieving financial well-being.

General Inquiries

What are the main features of money management apps?

Money management apps typically offer budget tracking, expense categorization, goal setting, and often provide insights into spending habits.

How do professional advisors differ from financial planners?

While financial planners focus on specific financial goals, professional advisors offer a broader range of financial services and often provide ongoing guidance.

Are money management apps secure for storing financial data?

Most reputable money management apps use encryption and other security measures to protect users' financial information.

![12 Ventajas de usar Magento para Crear tu Tienda Online [Infografía]](https://market.radartasik.id/wp-content/uploads/2025/08/Magento-para-tienda-online-1-120x86.png)