With JEPI Dividend Strategy: Passive Income for Global Investors at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

The JEPI Dividend Strategy is a powerful tool that offers global investors the opportunity to generate passive income through strategic investment choices. By exploring key principles, benefits, and global investment opportunities, investors can enhance their financial portfolios and achieve long-term success.

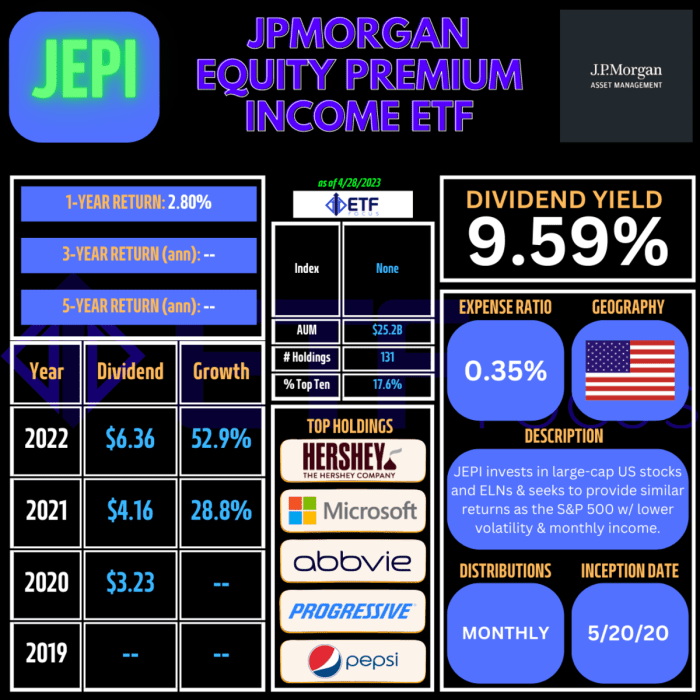

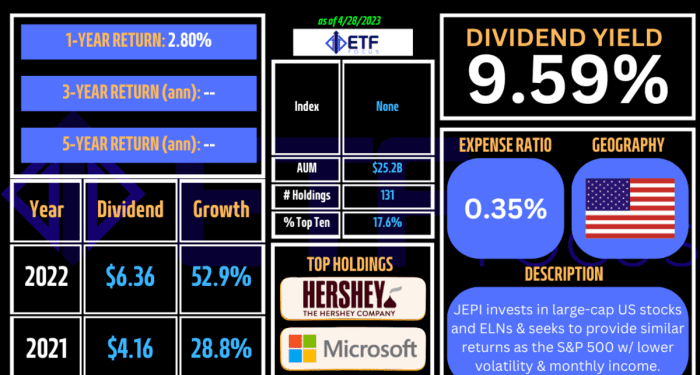

JEPI Dividend Strategy Overview

The JEPI Dividend Strategy is a passive income approach designed for global investors seeking to generate consistent returns through dividend-paying stocks.

Key Principles of JEPI Dividend Strategy

- Focus on High Dividend Yield Stocks: The strategy emphasizes investing in companies with a history of paying high dividends to shareholders.

- Diversification: Spread investments across various sectors and regions to reduce risk and enhance portfolio stability.

- Reinvesting Dividends: Utilize the power of compounding by reinvesting dividends back into the portfolio to accelerate growth over time.

- Long-Term Perspective: Adopt a buy-and-hold approach to benefit from the potential capital appreciation and income growth offered by dividend stocks.

Benefits of Implementing JEPI Dividend Strategy

- Steady Income Stream: Dividend-paying stocks provide a reliable source of passive income, especially during market downturns.

- Capital Appreciation: In addition to regular dividends, investors can benefit from potential stock price appreciation over the long term.

- Lower Volatility: Dividend stocks tend to exhibit lower volatility compared to non-dividend-paying stocks, offering a more stable investment option.

- Inflation Hedge: Dividend payments have the potential to outpace inflation, preserving the purchasing power of the invested capital.

Passive Income Generation

Generating passive income is a key financial goal for many investors looking to build wealth over time without actively working for it. The JEPI Dividend Strategy offers a way to achieve this by focusing on investing in dividend-paying assets that provide a steady stream of income.

Dividend-Paying Assets in JEPI Dividend Strategy

- Stocks: Investing in dividend-paying stocks of established companies can provide regular income through dividends.

- Real Estate Investment Trusts (REITs): REITs distribute a significant portion of their income to shareholders in the form of dividends.

- Bonds: Some bonds pay interest regularly, providing a predictable income stream for investors.

Importance of Passive Income for Global Investors

Passive income is crucial for global investors as it offers financial stability, diversification, and the opportunity for wealth accumulation without active involvement. It allows investors to build a reliable income stream, reduce dependency on a single source of income, and achieve financial independence over time.

Global Investment Opportunities

Investing globally opens up a wide array of opportunities for implementing the JEPI Dividend Strategy. By diversifying across different regions and countries, investors can mitigate risks and potentially enhance their passive income generation.

Regional Suitability

- North America: The US and Canada offer stable economies and a history of strong dividend-paying companies, making them attractive for dividend investors.

- Europe: Countries like the UK, Germany, and Switzerland have established markets with a focus on dividends, providing opportunities for consistent returns.

- Asia-Pacific: Emerging markets like China and India show growth potential, while countries like Australia and Japan offer stable dividend stocks.

Diversification in Global Investments

Diversification plays a crucial role in global investments using the JEPI Dividend Strategy. By spreading investments across various regions and industries, investors can reduce specific risks associated with a single market or sector. This strategy helps in balancing the portfolio and capturing opportunities for growth and income generation.

Remember, diversification is key to managing risk and maximizing returns in a global investment portfolio.

Risk Management

When it comes to the JEPI Dividend Strategy, managing risks is crucial for long-term success. By implementing effective risk management strategies, global investors can navigate potential pitfalls and uncertainties in the market, ultimately safeguarding their investment portfolios.

Diversification Strategy

One key risk management technique within the JEPI Dividend Strategy is diversification. By spreading investments across different sectors, industries, and geographic regions, investors can reduce the impact of a single negative event on their overall portfolio. Diversification helps to mitigate risks associated with economic downturns, sector-specific challenges, or geopolitical events.

Dividend Sustainability Analysis

Another important aspect of risk management in dividend investing is conducting thorough analysis of the sustainability of dividends. Investors should assess a company's financial health, cash flow, and dividend payout ratio to ensure that the dividends being paid are sustainable in the long run.

Companies with a history of stable earnings and consistent dividend payments are typically more reliable investments.

Monitoring and Rebalancing

Regular monitoring of the dividend stocks in the portfolio is essential for effective risk management. Investors should stay informed about any changes in company fundamentals, market conditions, or dividend policies that could impact their investments. Rebalancing the portfolio periodically to maintain the desired asset allocation and risk profile is also crucial.

Importance of Risk-Reward Balance

Balancing risk and reward is a fundamental principle in the JEPI Dividend Strategy. While seeking higher dividend yields can be attractive, it is essential to assess the associated risks and ensure that the potential rewards justify the level of risk taken.

By maintaining a balanced approach and considering both risk and reward, global investors can optimize their dividend investment strategy for long-term success.

Epilogue

In conclusion, the JEPI Dividend Strategy provides a pathway for investors to secure passive income and navigate the complexities of global investments. By prioritizing risk management and diversification, investors can maximize their returns while safeguarding their financial future. Embrace the power of passive income with the JEPI Dividend Strategy and unlock a world of investment possibilities.

Top FAQs

How does the JEPI Dividend Strategy help in generating passive income?

The JEPI Dividend Strategy focuses on investing in dividend-paying assets, which provide a steady stream of income without requiring active involvement.

What are some examples of dividend-paying assets that can be included in the JEPI Dividend Strategy?

Examples include stocks of companies with a history of consistent dividend payments, real estate investment trusts (REITs), and dividend-focused mutual funds.

How can global investors mitigate risks associated with dividend investing?

Global investors can mitigate risks by diversifying their portfolio, conducting thorough research on potential investments, and staying informed about market trends.

Why is balancing risk and reward important in the JEPI Dividend Strategy?

Balancing risk and reward is crucial to ensure that investors achieve a mix of stable income and growth potential while managing potential downsides effectively.

![12 Ventajas de usar Magento para Crear tu Tienda Online [Infografía]](https://market.radartasik.id/wp-content/uploads/2025/08/Magento-para-tienda-online-1-120x86.png)